I’m not a currency trader, but like it or not we are all currency traders now as the movements of the dollar and equities are tightly linked.

I’m not a currency trader, but like it or not we are all currency traders now as the movements of the dollar and equities are tightly linked.

Dollar up, markets down and vice versa.

Indeed recall in early September I had spotted a technical pattern that was bullish the dollar and we subsequently saw markets drop 10% in September as the bullish pattern played out:

What then happened was that equities bottomed at precisely the moment when the USD hit the technically important .236 fib and reversed from there:

Full disclosure: Subsequent to this event I was watching a potential bullish cup and handle pattern on the dollar which never confirmed and ultimately that pattern fell apart as the dollar kept dying and equities kept rallying in concert.

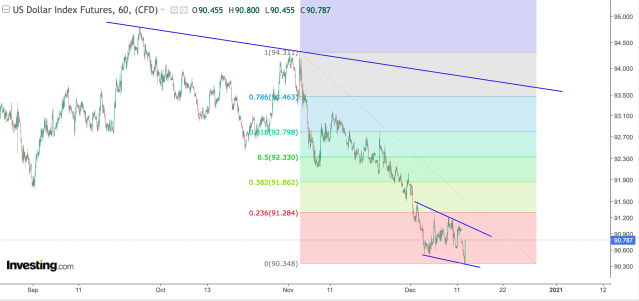

I bring all this up because I note the dollar is again forming a very similar pattern compared to early September, that of a bullish falling wedge:

Indeed today’s low in the dollar coincided with the recent trend line that has formed last week and today we saw a sizable reaction off of that trend line.

BUT, and this is important, the pattern is not confirmed as it has not broken above the upper trend line, but nevertheless the pattern is visible and shows potential for another dollar rally to come. Much I suspect in terms of how this will all play out has to do with the various stimulus events still ahead of us, be it stimulus in the US, Europe, Brexit trade deal and of course the barrage of central bank meetings still this week, Fed, BOJ and BOE, the same central banks that appear keen on mutually assured currency destruction.

Given the risk-off event from September tied to the dollar rising, the dollar again is key to watch in the days ahead in my view.

One additional observation: The dollar has declined sizably in November and into December which perhaps shouldn’t be a surprise given the extraordinary expansion in money supply:

Yet $ES has made virtually zero progress since the post election melt-up peak on November 9th:

That despite a strongly declining dollar. This could point to a lessening in efficacy in seeing dollar declines aiding equities which suggests not only a divergence forming but also suggests that a sudden resurgence in the dollar could end up pressuring equities more than perhaps currently expected given presumed positive year end seasonality.

In a world that see no risk, risk may be lurking unnoticed in the form of a potentially resurgent dollar.