I’m not sure, but I think I see signs that the US markets might gap down this morning. One can never be sure about these things, but my 53 years of watching markets virtually

I’m not sure, but I think I see signs that the US markets might gap down this morning. One can never be sure about these things, but my 53 years of watching markets virtually every day gives me an advantage. I can see the faintest suggestions of market direction that other people can’t. Although one can never be sure, can one?

Anyway, this chart says that the 5 day cycle projection is 3310, give or take 10 points, here at 6:10 AM in New Yawk.

Obviously, there are multiple support lines 3335-40. If they give way, should trigger a wave of selling.

So, what do you think? Dicsucs!

Click here for the longer range view, and subscribe!

You can follow my intraday snark at the Stool Pigeons Wire. Register there and join in!

Meanwhile, as I go through my Metastock personal screens for good day trading setups, I have not found a single chart that looks like a good buy. Everything is sell, sell, sell.

Probably means we’re close to a bottom. Any time things get lopsided, you can count on them going the other way.

Many of the Technical Trader long side picks have gotten stopped out with small gains or slight losses. Unfortunately, had only a handful of shorts, and of course, they’re doing extremely well.

I elected to make one new pick conditional on hitting a limit. It didn’t. Too bad. From the opening price on Monday, it’s down about 15%. These picks are published a day before the market opens, so it’s tricky, especially with a low priced stock like that one.

Have to ask myself why in the world, stodgy consumer staple stocks are suddenly acting so shitty. They’re either breaking down, or on the verge of breaking down.

Another sector with multiple sells popping up is insurance. They look godawful.

What is the narrative, Kenneth?

So, I’m looking at this chart that has gone from 6-20 since March. I’m thinking, must be some hot tech stock, right. Company name is Mosaic. MOS. Yeah, hot tech stock.

Right.

They make fucking fertilizer fergodsakes. They’re a bullshit refiner.

What a market.

We have a selloff in the pre market, but the TA says, don’t trust it yet. Or maybe, “Trust, but verify,” for those of you of a certain age, like me.

Meanwhile, as for chart picks, I didn’t see much that I liked in this week’s screens. I didn’t add any longs. We’re already loaded to the gills there. I added two shorts, and one is conditional on a limit price entry.

4 picks were stopped out last week. With the the 2 new picks, that will leave 16 open picks, including 12 longs, and 4 shorts.

List performance improved last week, with the average gain increasing from +2.9% to +3.8%. The average holding period rose from 12 calendar days to 13, which is still less than the usual 16-20 days because I added a slew of new picks the previous week.

Chart picks are theoretical, assume 100% cash stock trades, no margin, no options, no futures.

I once read somewhere that past performance doesn’t indicate future results, or something. Is that true? Hopefully it is, considering some of my past performances.

Technical Trader subscribers, click here to download the report.

Not a subscriber? Try Lee Adler’s Technical Trader risk free for 90 days!

Past performance doesn’t indicate future results. There’s always risk of loss. Chart picks are theoretical for informational purposes only. These reports are intended for professional investors and experienced individual traders. Do your own due diligence before trading.

Last week I was surprised when the US Government’s retail sales data hit a new high. No way, I said.

Well, Way!

Yes, some retailers are seeing booming sales, particularly online, and … wait for it…

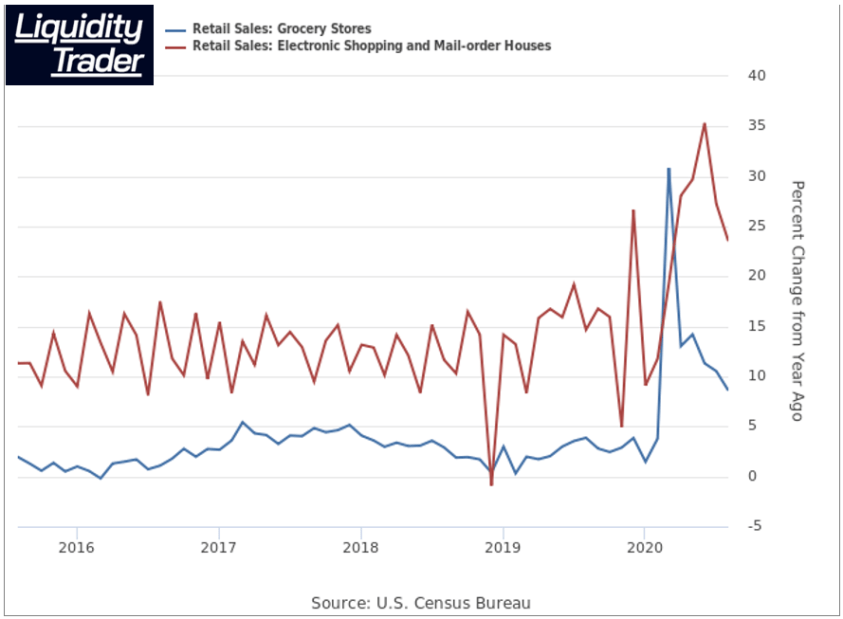

Grocery stores. Even after pulling back from the lockdown spike, they’re still up more than 7% year to year.

Now there’s a basis for a thriving, growing US economy.

Not.

And of course, there’s the surging growth in e-commerce. I’ve put it on a chart along with grocery sales going back 5 years for perspective. The average growth rate, which was already a sizzling 10-15% per year, has roughly doubled in e-commerce. The average growth rate for groceries has tripled. Apparently pandemics are good for some businesses.

Something struck me about this chart, apart from the COVID driven surge. Over the past few months, the annual growth rates in both series have been plummeting. “Growth” ain’t what it used to be. This drop implies contraction since July.

But my purpose here is not to pretend to be an eConomist. I just wanted to point out the government statistics, particularly those that the financial news headline writers feature, don’t tell the whole story.

Furthermore, we know that these sales are just coming out of the hides of other businesses. Lodging, travel, recreation, and transportation sales have collapsed. Gross tax collections show us the truth. The US economy is dead in the water, not growing at all, while remaining at a level a few percent below what it was last year at this time. It’s hard to gauge just how much in real terms, because we really have no clue how high inflation really is. But the nominal actual totals are lower and flat.

That’s what this report focuses on.

The issues then facing us are whether this will be the basis for more stimulus. That would mean more spending, more debt issuance, more pressure on the financial markets, and a need for more Fed support to prevent a market meltdown.

Here’s what the current Federal tax collections data tells us about what the real condition of the economy is, and what to expect as a result.

Subscribers, click here to download the report.`

Available at this link for legacy Treasury subscribers.

KNOW WHAT’S HAPPENING NOW, before the Street does, read Lee Adler’s Liquidity Trader risk free for 90 days!

Act on real-time reality!