Lots of proclamations and predictions out there. Lots of certitude expressed at a time of the greatest uncertainty. My take here: Everybody calm themselves on making predictions especially considering most never saw this crash coming and certainly not the event that triggered it.

Fact is humanity is now involved in a major battle. A health battle, an economic battle, a financial battle, and a monetary battle.

The odds are humanity will well survive all this and move on as it has done for thousands of years so no panic on that front. But reality is too that the long term ramifications of all this are totally unknown.

Hence the Wall Street Journal declaring a new bull market and the end of the bear market after a ferocious rally this week may well end up being pre-mature:

I wonder if any of the three reporters behind this article have ever experienced a structural bear market. https://twitter.com/WSJ/status/1243267094852055041 …

The Wall Street Journal✔@WSJ

Breaking: A new bull market has begun. The Dow has rallied more than 20% since hitting a low three days ago, ending the shortest bear market ever. https://on.wsj.com/2WJpA1i

I’ll leave technical comments for my upcoming Weekend Video, but suffice to say this rally was very much technical based. We talked about it in advance in Month End Rally, we gave support levels to consider before the low in Fear and we gave the rally historical context in 1929 Redux, and tracked the rally’s progress in Monster Move.

That’s about as good as one can do in predicting anything in this unpredictable environment. And technicals help greatly in navigating this jungle.

But celebrations may be far too premature.

For one, the health battle is ongoing and has not yet reached its peak, nor is there any clarity on how this virus will behave not only in 2020 but beyond.

The economic battle is real and hard. Yesterday’s job claims, historic as they are, are not the end but the beginning:

A sudden shock to the system, the extent of which remain unclear. Yes hope it being temporary all you want, but we can’t know the long term ramifications yet.

So yes Congress did the right thing to intervene and is still in process of approving the biggest stimulus package in history dwarfing the stimulus packages of 2009:

This too is just the beginning. These measures will help in the short term, but will be meaningless for many who will face unemployment for longer than a month or two.

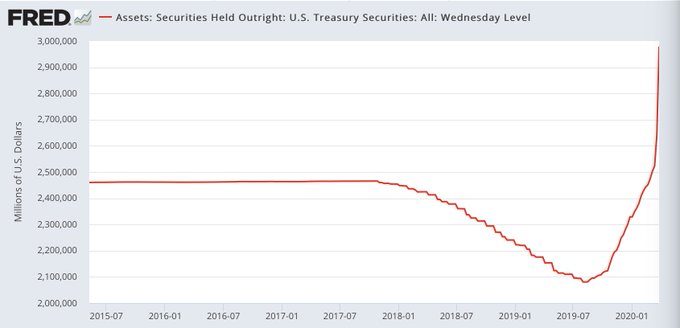

While these wounds will eventually heal the monetary battle will leave scars for years to come. The Fed’s balance sheet now slated to double to $9 trillion – $10 trillion. Helicopter money.

So yes, this too is just the beginning:

But the historical context being profoundly disturbing and best masked by veiled humor that brings tears to the eye:

I know nobody wants to deal with consequences now. We have to win this battle in the here and now. But I keep asking, where is this is all going, and what will the ultimate consequences be?

Don’t want to end on a downer but I am reminded of the great Johnny Cash cover of Hurt:

What have I become

My sweetest friend

Everyone I know goes away

In the end

And you could have it all

My empire of dirt

I will let you down

I will make you hurt

Oh and it is going to hurt. And the long term financial consequences will be dire. Already impossible to solve in the years preceding this crisis the structural problems have just become worse. Much, much worse. And nobody has any solutions to this. We will win the health battle, and we will overcome the economic battle in the near term and growth will reemerge, but the financial and monetary battles that are unfolding here may end up making our global financial system an empire of dirt and it’s going to hurt. We hurt ourselves.