Yes, the Fed keeps monetizing the debt. Just look at today’s Treasury Cash Management Bill auction.

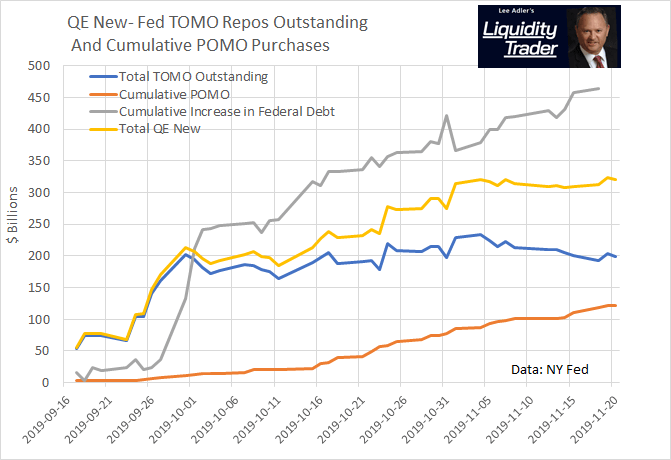

The Treasury said that it was way oversubscribed. No shit, Sherlock! Since Friday the Fed has pumped $18.6 billion in permanent money into Primary Dealer accounts via POMO outright purchases of Treasuries. Then yesterday and today it rolled about $100 billion in TOMO repos to make sure that money stays in the banking system.

Bottom line: The Fed has been monetizing approximately 60% of the US Government’s budget defecation. That means that the dealers, banks, investors, and the rest of the world need to absorb only 40%. That ratio seems to be enough for the central bank to win the battle to keep the stock and bond market asset bubbles inflated.

Whether it’s a strategy that will win the “war” remains to be seen.

What a disgusting mess.

Term and Type: 16-Day Bill

CMB: Yes

High Rate: 1.540%

Investment Rate: 1.567%

Price: $99.931556

Allotted at High: 52.15%

Total Tendered: $54,450,259,000

Total Accepted: $15,000,034,000

Auction Date: 11/20/2019

Issue Date: 11/26/2019

Maturity Date: 12/12/2019

PDF | XML

Get my complete analysis and forecast at Liquidity Trader.

Read Lee Adler’s Liquidity Trader risk free for 90 days! Satisfaction guaranteed or your money back.

90 day risk free trial offer is for first time subscribers only.