“And I heard a voice in the midst of the four beasts, and I looked and behold: a pale horse. And his name, that sat on him, was Death. And Hell followed with him.”

Not to get all biblical on you, but I was reminded of this quote from Johnny Cash’s brilliant song “The Man Comes Around” as I came across multiple headlines in the past 24 hours, voices of different parts of the market spectrum.

You know where I stand: From my perch we’re in the midst of a giant Fed induced asset bubble and I’ve written extensively about it. In my view the Fed is reckless, irresponsible, and unaccountable and their liquidity actions are setting up investors for a disaster to come.

Each bubble has its voices and in hindsight in particular they offer testimony to how dangerous markets really were at the time, how obvious the risks ignored were, yet so ignored by participants as momentum kept rolling on before the rug gets pulled.

Hence I thought it might be of interest to document some of these voices:

Guggenheim’s Minerd, a $275B money manager:

“Guggenheim Partners Global CIO Scott Minerd said in a letter to clients that the elevated prices in financial markets show a “cognitive dissonance” from economic reality that has created a dangerous bubble among debt assets.

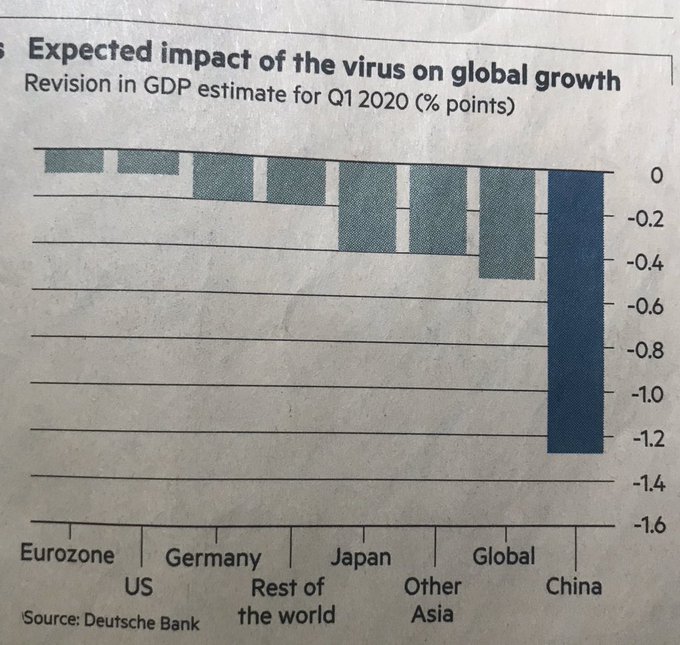

Liquidity from the Federal Reserve and other central banks and increased demand for bonds from ETFs are masking the problems in the market, Minerd said, and the coronavirus outbreak is an example of an economic shock that could prick the bubble. The money manager said GDP growth in China in the first quarter could be as bad as negative 6%.

“This will eventually end badly. I have never in my career seen anything as crazy as what’s going on right now,”

“In the markets today, yields are low, spreads are tight, and risk assets are priced to perfection, but everywhere you look there are red flags,”

“We are either moving into a completely new paradigm, or the speculative energy in the market is incredibly out of control. I think it is the latter. I have said before that we have entered the silly season, but I stand corrected,” Minerd said at the end of his letter. “We are in the ludicrous season.”

Then from Mark Spitznagel, the founder of Universa Investments:

Right now, stocks, with the Federal Reserve winds blowing at their backs, are “distorted” and “no longer tethered to fundamentals,” Spitznagel warns, and that makes for those chasing returns extremely vulnerable.

“These monetary distortions lead to this reckless reach for yields that we are all seeing,” he said. “Randomly go look at a screen and it’s pretty crazy. Big caps, small-caps, credit markets, volatility; it’s crazy. Reach for yield is everywhere.”

Spitznagel explained to Vanity Fair that, at this point, central bankers have lost control and don’t know how to right their wrongs.

“They will never be able to ‘normalize’ rates,” he said. “In our lifetime, recessions and stock market crashes really have been instigated or started by central banks sort of pulling away the punch bowl. They raise rates and that has led to a slowdown and ultimately has led to these crashes that we see.”

He said they’re not stupid, just reckless.

“They realize that global economies are in a situation now where central banks can’t pull away,” he said. “And they’re bluffing if they say they can.”

And you get comments like these from a former big 3 car executive:

“I talked to people at Goldman Sachs, who are usually the world’s greatest experts on explaining stock prices, and they’re now asking me whether I have any idea what the heck is going on with Tesla stock,” he said. “Nobody can explain it, it’s so far beyond any fundamental return that any shareholder could ever expect.”

Elon Musk’s electric-car startup currently boasts a market capitalization of $145 billion — dwarfing Ford, Chrysler, and GM’s combined market cap of $103 billion. Tesla stock is no longer tethered to anything tangible, Lutz argued.

“It’s driven purely by psychology or almost a mass psychosis,” he said, warning the rally won’t last. “Ultimately, the share price responds to financial fundamental reality, and that day will come.”

Nobody can tie any price action to fundamentals. Because it’s not.

It’s all this:

The @federalreserve is a mere $23B away from an all time high in treasury holdings.

Prices that are not tied to fundamentals are inherently a bubble and consequently dangerous. One would think investment professionals would advise clients to reduce risk and take advantage of the strength to lock in some profits. Oh no Sir, not in this bubble.

Instead embrace irrationality and proudly wear its label as BAML does:

“800 rate cuts on and investors throw money at everything: BofA. BofA’s chief investment strategist Michael Hartnett said the bank remains “irrationally bullish” in the first quarter as positioning is not yet “euphoric”.

The S&P 500 is currently trading at a 12-month-forward price-to-earnings ratio of 18.8, well above its 30-year average, and Hartnett recommended his clients sell stocks when the ratio crosses 20.”

Don’t sell anything yet. Wait for even higher prices. Here, with $NDX over 400 points outside its monthly Bollinger band:

Be irrationally bullish. Hey, maybe it’ll work out.

As far as I’m concerned we’re in the blow-off phase of this artificial bull run that ignores everything and is counting on any bad news to remain contained.

And I heard a voice in the midst of this bullishness:

Every bubble bursts and then:

“The hairs on your arm will stand up

At the terror in each sip and in each sup.

Will you partake of that last offered cup

Or disappear into the potter’s ground

When the man comes around?”

Do you hear the voices? Are you listening?