Is there any political risk for equities in this election year?

The 2016 US election has been a nirvana for US corporations who benefited the tremendously from the Republican led 2017 tax cuts that went into full effect in 2018. Taxes for US cooperations dropped dramatically and a lot of these tax cuts benefits went into buybacks which recorded record amounts in 2018 and 2019.

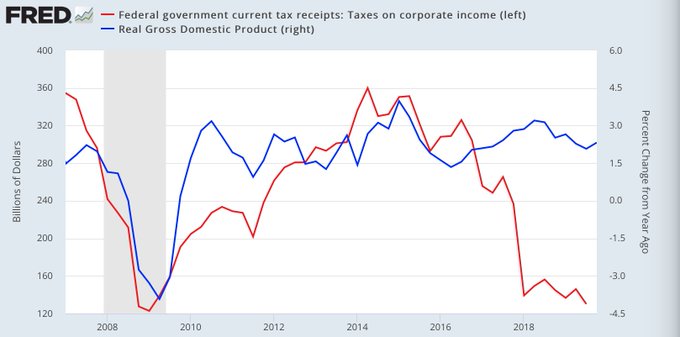

It probably doesn’t get better than this for US corporations although one may argue that the tax cuts have yet to translate into any meaningful increase in economic growth other than a temporary sugar high:

“Corporate tax cuts will produce massive new economic growth”

Well, we’re waiting.

For Wall Street this coming US election could have negative consequences depending on the outcome, or it could have little to no impact.

The general view is if President Trump gets reelected and Republicans retain control of the Senate the current very tax friendly environment for US corporations will remain in place.

If a business friendly and centralist Democrat wins the election, say a Michael Bloomberg or a Joe Biden, then there may be some moderate change in tax policies, but nothing dramatically different. Unless of course a more populist left of center candidate wins such as Elizabeth Warren or Bernie Sanders then the threat to corporate America may be more severe, but that would really depend on whether Democrats would also take control of the Senate. A hypothetical President Warren or Sanders would find it visually impossible to pass changes to the tax code with a GOP lead Senate.

Too far apart are the ideological differences.

At this stage we don’t know who the Democratic nominee will be nor how the election will turn out, but Democrats face several key hurdles that have nothing to do with politics, but rather history, the economy and sentiment. And these hurdles suggest that the odds of President Trump getting re-elected are currently quite high.

While it’s true that President Trump never has had a plurality support of the overall population the 2016 election has already proven that this doesn’t necessarily mean anything. America is not a democracy based on plurality of the vote, but rather a republic and a president is elected by the electoral college. And hence, while Hillary Clinton received the plurality of the popular vote in 2016, it was the electoral college that decided the outcome of the presidency.

That’s the way it is, a problem for Democrats not lost on Jame Carville who recently stated: “Eighteen percent of the population controls 52 Senate seats,” Carville said. “We’ve got to be a majoritarian party”.

Translated: For Democrats to win, they need to win big, not only the presidency, but also the Senate

Problem for Democrats is this: Whatever one’s political leanings, many people also vote with their pocket books, not on ideology.

Oh sure it appears most American’s are pretty much locked into ideological camps these days and there’s little to no movement in political view points based on the running MSN poll:

Steady as she goes. At the same time President Trump’s approval ratings appear to be improving according to the latest Gallup poll:

Why? Because currently economic news continues to be very supportive of the pocketbook sentiment.

With 3.6% unemployment, stock markets at all time highs and wage growth rising 3.2% in the past year, Americans are not only positive about the past year, but also for their personal financial outlook this coming year:

And note: Past election cycles suggest party control shifts as people are feeling financially worse off.

Democrats lost the presidency in 2000 as the US economy moved toward recession. Republican’s lost the presidency in 2008 as the financial crisis unfolded. In this sense the 2016 election then was perhaps a bit out of character in terms of the result, but not in terms of the vote as indeed the plurality of the vote was for Hillary Clinton.

No matter, Americans currently feel positive about their finances and they are confident in general as sentiment is positive:

And it’s not a surprise. Historically sentiment is positive when unemployment is low. But also note that confidence shifts on a dime once the unemployment picture shifts.

As Americans are politically very divided none of these data points will matter to a majority of voters. Many will vote for President Trump no matter what, some will vote for whoever the Democratic nominee will be no matter what. But US elections are decided on the margin of swing voters. And to the extent that consumer confidence and perception of financial well being remain high, a portion of swing voters will vote with their pocketbook and that implies a vote for President Trump. If the pocketbook is good why roll the dice and risk change or similar goes the calculus.

Perhaps the broader message: Republicans can’t afford to lose the economy or markets this year. Perception is reality and dropping markets are not good business for confidence.

So, from that perspective, unless these factors change dramatically ahead of the November election, it may already be game over for Democrats to win both the presidency and the Senate. Wall Street, for now, looks safe and political risk to equities appears low.