Panic in the ‘save stocks at all costs’ world. Calls from the President on down demanding the Fed cuts rates on an emergency basis before even the March meeting.

The G7 is having a big “OMG” conference call tomorrow and have asked all the big central banks to participate as well.

The forces of intervention are gathering and stewing over what they might do to minimize the economic storm clouds gathering and their primary goal is to prevent stocks from selling off any further. So intervention it’s all coming (the BOJ already bought ETFs overnight) and we’ll see what the fall out from all this will ultimately be.

But I wanted to briefly follow up on something that highly impressed me on Friday. I’ve discussed it in this weekend’s update video, but wanted to follow up on the charts as we saw sizable follow through on them today.

Again, the bounce off of record $NYMO oversold conditions made perfect sense and I outlined some of these support zones as bricks were falling on Friday.

It’s not the market decline that stunned me, it’s the absolute perfect alignment of key charts and components hitting respective key technical zones ALL AT THE SAME TIME and that was the bottom on Friday.

Now we don’t know if that’s “the” bottom, but it all made a superbly strong case for the long trade on Friday. Since I put the charts in the video only its worth to get an appreciation of them here in this post with the follow through.

These charts really make the case for technical analysis helping identifying risk/reward pivots and also suggest that the big quant programs are adhering to them.

I humbly submit that the confluence of all these technical levels is no coincidence.

And remember I pointed it out live on twitter during the carnage, so this is no hindsight quarterbacking:

First showing that the level got hit:

And then that it held as support:

$ES fib has held at support, nice bounce off of there, not confirmed low yet, but a good pivot to use.#keepitsimplestupid

Today then we got the follow through off of that fib:

But as I outlined this weekend it was amazing to see it all unfold live across these other asset classes at the same time.

Here’s the $DJIA hitting it’s .618 fib:

Perfection and what a bounce off of that.

And $NDX tagging its 200MA:

Also perfection.

$AAPL hitting its .382 fib perfectly:

I mean come on. MAs, fibs all relevant and extremely meaningful for gauging risk and reward. Hence Friday was absolutely not the time and place to keep pressing short despite the bad news flow, at least not from a technical perspective.

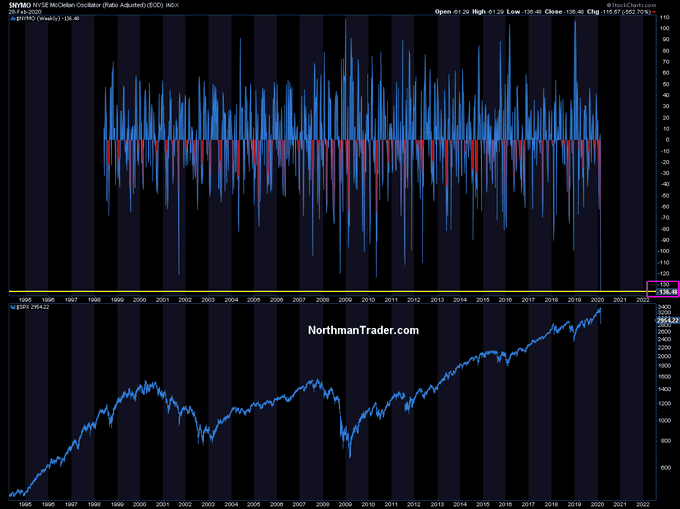

Could it have gone lower? Sure, but again with a $NYMO reading such as this….

You don’t often to get say that the market has done something it’s never done before, but here it is.

The LOWEST weekly close on $NYMO since its existence.

-136!!

…you’re just looking at good historic risk vs reward to be pressing short.

And even small caps hit a key support area at the same time:

In summary: The bounce since the Friday lows has made absolute perfect technical sense, but even I, who has watched charts for so long, have to admit how impressed I am by the perfect alignment, dare I say coordination, of all these asset classes hitting precise technical levels all at the same time.

Impressive any way you cut it or slice it.

The market technician in me rejoices as it not only validates our craft, but it shows that, despite all the artificial influences on our markets (i.e. central banks) technicals matter even when, or perhaps especially when, central banks lose control. So if any uninformed ever tell you that technicals don’t matter or that it’s just mumbo jumbo, show them this article.

The market just put a technical master class on display for all to see.

Now this bounce rally here has to navigate the polar opposite of what it did on Friday: It has to negotiate resistance levels. Happy level hunting