This is a syndicated repost published with the permission of Logan Mohtashami. To view original, click here. Opinions herein are not those of the Wall Street Examiner or Lee Adler. Reposting does not imply endorsement. The information presented is for educational or entertainment purposes and is not individual investment advice.

Year in Review

In December of 2014, I made several predictions for the housing market in the coming year and I am both pleased and disappointed that most of what I predicted did in fact come true.

I am pleased to report, that as I predicted, all housing demand metrics grew year over year in 2015, mostly because the bar set in 2014 was very low. New home sales showed low double digit growth, (as I predicted), but did not meet the lofty sales expectations set by many of our housing forecasters. Existing homes attracted more mortgage buyers than in 2014 and purchase applications also grew from the lowest level in this economic cycle. 2014 was the worst year ever recorded for purchase applications when adjusted for population. Headline numbers were back to the mid 1990 levels. The growth in purchase applications that I predicted for 2015 wasn’t far fetched. Even though there was growth, we did not surpass the highs of 2013, which makes 2015 the second worst year ever recorded for purchase applications, once adjusted to population. But there were more mortgage buyers in 2015 than 2013 so the purchase application data did not capture all the mortgage buyers.

Multifamily demand gave housing starts and permits legs in 2015, as rental properties continued to be a hot commodity. Mortgage rates and inflation stayed low, and the 10-year note yield got near my predicted low level range of 1.60% with a 1.64% print that held. We saw slow and steady growth in housing overall in 2015, but 2016 brings with it some interesting changes – not the least of which is the end to the zero interest rate policy, and the introduction of TRID. With those changes in mind, I present seven predictions for the housing market in 2016.

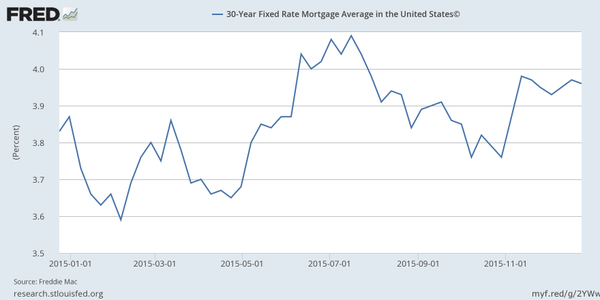

1) Mortgage Rates and Bond Market

I predict mortgage rates will be in the range of 3.625% to 4.625% during the year. I anticipate the 10-year note will stick in the same channel as the past year with a yield range of 1.60% to 3.04%. Yes, that is 1 handle on the 10-year even with the Fed starting their rate hikes. I predict long term rates will remain low due to demographic deflation (more on this later), unless ECI wage inflation and CPI core inflation rise. In any event, I don’t expect the 10-year breaking above 3.04%. Long-term rates won’t rise in a meaningful way unless inflation picks up.

From the St. Louis Fed:

2015 Mortgage Rates

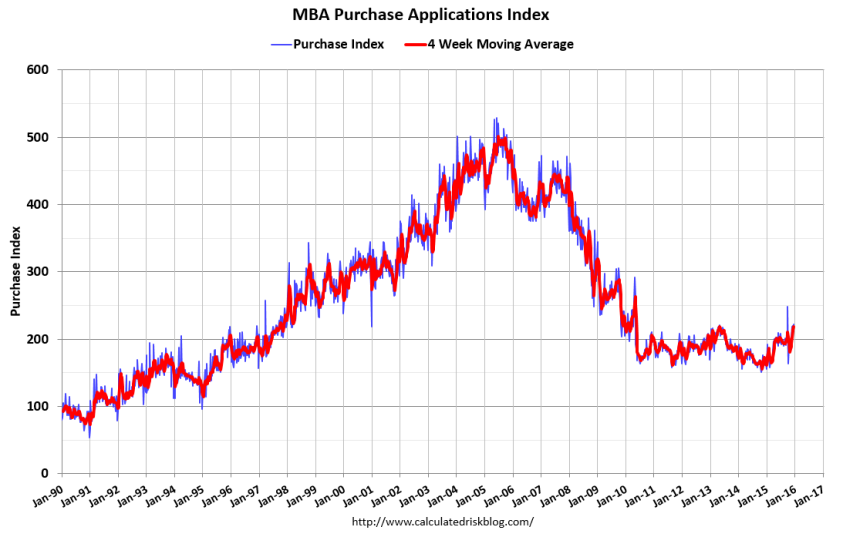

2) Mortgage Purchase Applications

For housing to show growth in 2016, purchase applications need to show year over year growth during the “heat” months,” from the second week of January to the first week of May. I predict 4% – 9% growth in purchase applications in 2o16.

Mortgage demand took a hit in 2014 when rates rose to 4.5% so I expect some softness if mortgage rates get to 4.5% in 2016. We never reached that mortgage rate level in 2015 so the market wasn’t ever tested at 4.5%.

From Calculated Risk

http://www.calculatedriskblog.com/2015/12/mba-mortgage-applications-increase-in_23.html

3) Existing Home Sales, Inventory and TRID

The negative year over year growth in existing home sales of 2014 created a low bar to beat in 2015. If 2014 existing home sales had shown modest growth then year over year growth for 2015 would have been flat to negative.

In 2016 we have to be mindful of housing inflation and the impact of the oil crash and loss of mining jobs on some housing markets. Cash buyers leaving the housing market and the economic effects of the commodity crash could also negativity affect some housing markets. I believe we will see for the first time in this cycle, monthly prints of less than 20% cash buyers on some reports, which is still very high on a historical basis but a double digit decline from the 2010-2014 trend. However, if the market maintains around 20% cash buyers and mortgage buyers stay on trend, we should see some growth in 2016. With all these factors in mind, I predict total existing home sales to be between 5.13 -5.43 million in 2016.

Inventory didn’t grow in 2015, because owners had too much debt on the books to sell and move up. If we work off the most common home affordability index, homeowners need to have at least 28%-33% equity, conservatively, to sell, pay transaction cost and move up. With another years of price gains under our belt, we should see a bit more inventory in 2016 compared to last year.

TRID rules are a result of the Consumer Financial Protection Bureau (CFPB), the Real Estate Settlement Procedures Act (RESPA) and Truth in Lending Act (TILA). Last month’s existing home sales were heavily impacted by TRID, because sales were delayed and thus not counted in the monthly data. We will probably experience a few more months of delays due to TRID, but by May or June of 2016 this should no longer be an issue.

From Doug Short

http://www.advisorperspectives.com/dshort/updates/Existing-Home-Sales

4) New Home Sales

I predicted 8%-12% growth in new home sales in 2015, with the caveat that we could see upside potential if median prices stabilized. Median prices for new homes have cooled due to a shift in sales to smaller, lower priced homes. Nevertheless, new home sales growth has been decelerating since rates moved from 3.625% to 4.125%. Those who estimated growth of 24%-41% growth didn’t even come close to being right in 2015. For 2016, I am predicting growth of 4%-8%, the lowest growth estimates I have given in this cycle. However, just like 2015, if we can get more lower priced homes in the market, new home sales growth can be much higher than 8%. When only 500K new homes are being sold in a market of over 153 million working Americans, it wouldn’t take much to move the needle. If I was one of these agenda driven housing bulls, I would use these soft sales numbers as case for growth and likewise, if I was a housing bear, I would be mindful that new home sales are still very low.

From Doug Short http://www.advisorperspectives.com/dshort/updates/New-Home-Sales

New single-family home sales are about 17% below the 1963 start of this data series. The population-adjusted version is 51.6% below the first 1963 sales and at a level similar to the lows we saw during the double-dip recession in the early 1980s, a time when 30-year mortgage rates peaked above 18%. Today’s 30-year rate is around 4%.

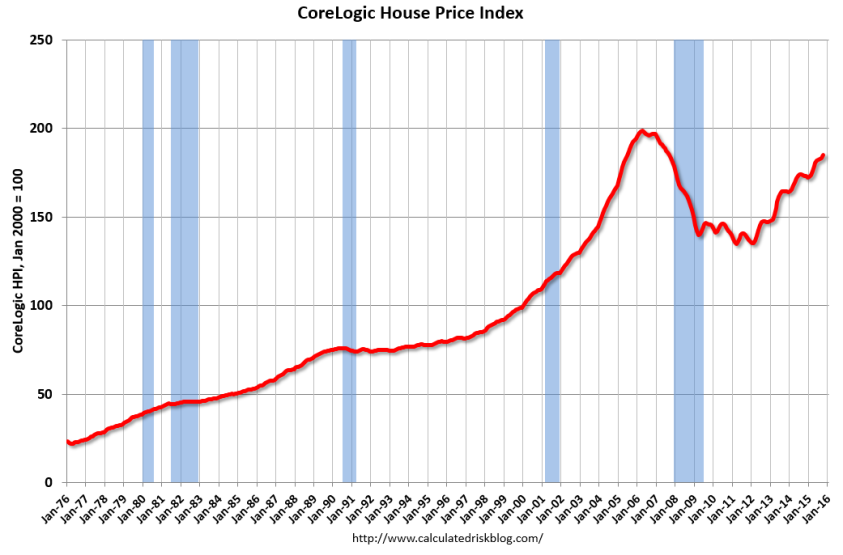

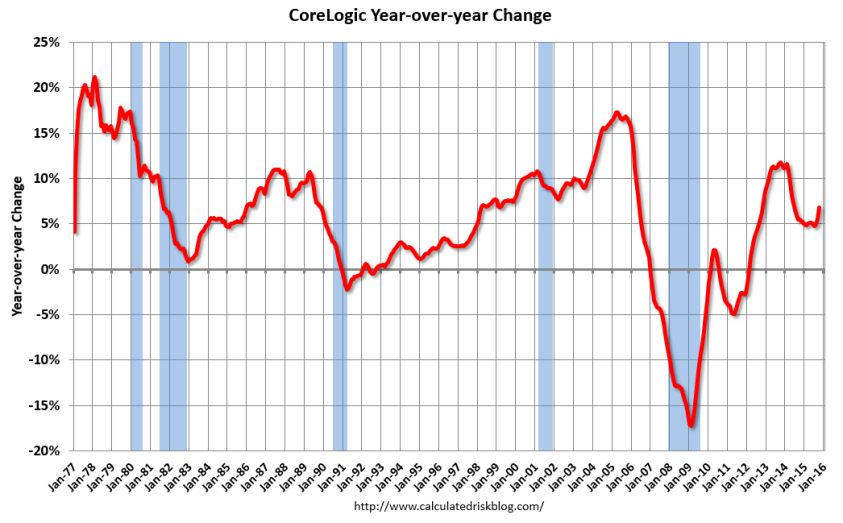

5. Home Prices

Home prices still have the legs to run higher in 2016, like they did in 2015, because inventory is high enough nationally to provide choice but not so high to cause price declines. In fact, from 2012 -2015 the annual months of inventory were higher than at any point from 1999 – 2005.

We would need 6 months of inventory and a job loss recession creating a fresh wave of distressed sales, in order for any meaningful national downturn in prices to occur. Inventory is nowhere close to 6 months and only states dependent on oil and mining are seeing recessionary type job losses. I predict existing home price growth of 1-4% for 2016.

From Calculated Risk

http://www.calculatedriskblog.com/2015/12/corelogic-house-prices-up-68-year-over.html

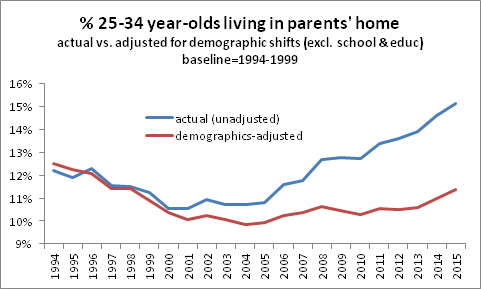

6. Housing Starts

I may sound like a broken record, as I have said the same thing about housing starts for years now. I expect a slow and steady rise in housing starts. Renting demand is booming and this gives legs to housing starts, off-setting a very soft trend upward for single-family home starts. The financial networks have been promoting the thesis of pent of demand for years now. We did have massive pent up demand, but it was for rental housing not single-family homes. I predict the demand for ownership won’t improve significantly until the years 2020-2024. Until then, expect a slow and steady rise for starts and permits. We need the young to rent, hook up, date, find a steady relationship, pop the question, and have kids before we have any major boom in single-family home sales. Even in 2015, the number of 25-34 year old Americans living with their parents is rising.

From Jed Kolko ( a good follow on twitter)

http://jedkolko.com/2015/11/23/why-millennials-still-live-with-their-parents/

Like new home sales, starts and permits, adjusted to population, are very low. This low level puts limits to the downside. In areas where oil and mining heavily influence the economy such as Houston, Texas, we already see a noticeable decline in housing activity. Otherwise slow and steady is the name of the game for housing starts and permits.

From Doug Short :

http://www.advisorperspectives.com/dshort/updates/Housing-Permits-and-Starts

7. U.S. Economics

The strong dollar and the collapse in oil and the mining sectors have taken a bite out of economic output in certain states, but auto sales and other personal consumption metrics have kept the US economy on a slow and steady growth path. I predicted 2.5% growth in 2015 with job gains around 210K a month. GDP growth is going to be slightly lower than I predicted, unless Q4 falters. YTD job gains are running at 209K per month with one more jobs number left to be revealed for the year.

Prognosticators, who have been calling for a recession due to the commodity crash, are missing the point. This is not a U.S. story but is a significant issue for other countries like China, Japan, Europe, Russia and Brazil who are suffering through both the commodity crash and the demographic trend of aging populations. I predict 1.9% to 2.3% growth in the U.S. for 2016. I predict job creation numbers to be down slightly to about 190 -205K/month. The JOLTS data (Job Opening Labor Turnover Survey) is now showing that we are entering into a phase of a tighter labor market. With the unemployment rate at 5% and 5.4 million job openings, we are seeing the first breath of a tight labor market.

On the other hand, prime age labor force is not growing fast enough to create a major boom in job creation numbers. The demographic group ages 21-25, is huge for the U.S., but they need a few more years before they impact the labor market in a significant fashion.

On Recession Watch?

For our friends who constantly post “a recession is coming, a recession is coming” here are a few recession indicators to follow in 2016 to determine if a recession is, in fact, coming.

- The Fed has started to hike rates, and, typically, the Fed is well into the rate hike cycle before any recession.

- Unemployment claims would need to rise well above the 300K, on a 4-week moving average, without a 1-time economic event as a reason, such as the Sandy storm/flood. As you can see below, even with the commodity crash and jobs lost due to it, we haven’t experienced an increase in claims.From Doug Short

http://www.advisorperspectives.com/dshort/updates/Weekly-Unemployment-Claims

Also you would need to see more sectors with increased unemployment claims . Mining companies were negative in job creation number, and manufacturing jobs were barley positive – but these two sectors alone cannot bring the US economy into a recession.

Also you would need to see more sectors with increased unemployment claims . Mining companies were negative in job creation number, and manufacturing jobs were barley positive – but these two sectors alone cannot bring the US economy into a recession.

3. If leading economic indicators (LEI) trend lower for 4-6 months, with rising unemployment claims, then we may have a recessionary trend forming.

From Doug Short

http://www.advisorperspectives.com/dshort/updates/Conference-Board-Leading-Economic-Index

2016 brings a change in the FED Funds Rate. The FED has finally abandoned the zero interest rate policy raising rates to 0.25%. I found it strange that those predicting recession would believe in a recession, crash and depression when the FED has never raised rates once and core inflation isn’t running wild. Now with a 0.25% rate hike, I expect we will be seeing more of the melodramatic 2nd Depression predictions in 2016. With no real over-investment thesis outside of oil, 2016 should not have a recession unless we have a major economic event, currently unforeseen.

In general, for housing in 2016, expect slow and steady growth. However, as I have maintained since 2010, we still do not have enough qualified home buyers to drive a real recovery in housing.

My thesis back in 2010 for my 2011 Housing Predictions

“The longer term consequences of an unstable residential real estate market may be more serious than just the destruction of individual wealth. The ideal of middle class home ownership may be at stake. The census bureau reported a 7% decline in national rental vacancy rates in 2010, along with an overall decline of 0.7% in home ownership rates compared to a year ago. There were fewer “organic” buyers, more renters and more investment buyers in the market in 2010 and I expect this trend to continue into 2011. Are we at the beginning of a sociological movement away from middle class home ownership and towards a cultural split between the investment property landlords and their renters both of whom may have less personal investment in neighborhood security, local schools and shared public facilities compared to primary homeowners.”

In years 2020-2024 we should see much stronger ownership demand for housing but until then, debt, demographics and debt to income ratios, will limit home ownership but continue to expand the demand for rental properties.

Note I will be discussing my 2016 Housing and Economic Predictions on Bloomberg Radio with Kathleen Hays this Wednesday December 30th at 12:30 pm Pacific Time.

http://www.bloomberg.com/radio/

Logan Mohtashami is a senior loan officer at AMC Lending Group, which has been providing mortgage services for California residents since 1988 and is in a partnership with ZeneHome.com

Join the conversation and have a little fun at Capitalstool.com. If you are a new visitor to the Stool, please register and join in! To post your observations and charts, and snide, but good-natured, comments, click here to register. Be sure to respond to the confirmation email which is sent instantly. If not in your inbox, check your spam filter.