Retail sales growth cooled in June, possibly robbed of sales by a torrid stretch in May. There was no evidence in the data of either a slowing economy or one that is overheating.

According to the Commerce Department’s Advance Retail Sales Report, retail sales rose by 0.4% in June (month to month) and were up a whopping 5.7% annually on a seasonally adjusted nominal basis, not adjusted for inflation. However the seasonal adjustment factor appeared to play havoc with the year to year comparison. On an actual, not adjusted basis, the year to year gain was a more modest 3.7%. The seasonally adjusted estimates will be revised several times before they are finalized.

The median forecast of economists in mainstream media surveys was for sales to be up 0.7% month to month. The economists’ consensus was too high. They were too low in May, whipsawed again. But the game the media plays of surveying economists for their guesses each month goes on.

Note: When analyzing retail sales, I’m interested in the actual volume of sales, not the inflation skewed dollar total. To get to the kernel of the matter, I look at the real, not seasonally finagled retail sales, adjusted for top line CPI inflation (not core which normally understates the actual). Then I back out gasoline sales, which are a substantial portion of total retail sales. Gasoline sales distort total retail sales higher when gas prices are rising, when they actually act like a tax on disposable income and reduce non-gasoline sales. On the other hand, when gas prices fall, the top line total retail sales figure will understate any gains in the volume of sales. Gasoline sales typically account for around 12% of total retail sales. By subtracting gas sales and adjusting for inflation, the resulting number represents the actual volume of retail sales.

This analysis uses not seasonally adjusted (NSA) data due to the inaccuracy and potentially misleading nature of seasonally adjusted data.

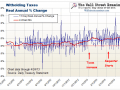

The year to year change in real retail sales, ex gasoline sales and adjusted for inflation in June was a gain of 2.9% which was slower that a gain of 4.7% in May.

On a month to month basis June is almost always a down month. This year, the monthly drop was -5.9%. That was worse than last year at -4.2%, and worse than the -2.6% average change for the 10 year period from 2003 to 2012. However, the year to year gain of 2.9% remains well within the norm of the past 3 years. The monthly weakening in June appears to be the usual random movement within a range. It’sway too early to conclude that it’s anything more than that, although some pundits are sure to jump on the weaker than expected results for June and blame it on the fecal cliff secastration. That’s political posturing, not serious analysis.

Rising gas prices are a de facto tax on consumers that can cause reduced consumption of other goods and services since demand for gasoline is relatively inelastic. A rise in gas prices cuts consumers’ ability to spend more on other things. Conversely, a fall in gas prices is like a tax cut that puts a little cash back in consumers’ pockets. Gasoline prices fell about 13 cents a gallon through June according to the US Energy Information Administration. Theoretically this factor should have boosted retail sales ex gas, but other factors apparently depressed spending. It could have been just normal giveback from what was a very merry month of May.

Consumers were hit with increased Federal payroll and income taxes in January. Sequestration cuts have taken effect gradually since March. Those factors were supposed to depress retail sales, but if they have, it has not shown up in this data (or anywhere else). Falling gas prices may have offset those impacts. Gains in withholding tax collections greater than the increase in tax rates suggest that the increase in the number of jobs is helping to sustain slow growth in retail spending.

The Fed’s QE3 and 4 and the Bank of Japan’s QE campaign continue to risk stimulating rising gasoline prices, but so far, the central banks have been skillful at jawboning speculators away from crude oil and other commodities purchases. The Fed has been threatening an end to QE in speeches and FOMC meeting minutes since January. Lately they’ve been raising the verbal pressure, but then acting like crybabies when the stock market sells off a little or yields rise. One of the regulars on the Capitalstool.com message board thinks this back and forth on the Fed’s part is deliberate. He wrote a very sharp brief take on the issue.

US population is growing at slightly less than 1%. A retail sales real growth rate of several times that is remarkable. The wealthy and tourists are helping to boost sales. However, the growth rate has trended down even as the Fed has engaged in more money printing. QE simply is not working to boost employment or consumer demand. I think that’s the real reason the Fed is getting ready to slowly reduce QE. The Fedheads know that it does not work to spur economic growth, but it does inflate asset bubbles.

Does any of this matter for stock prices? Not directly, no. Stocks only turned down when the Fed stopped growing its balance sheet in mid 2007. This was after retail sales growth has been slowing for several years. The real driver of the market is cash flow from the Fed to the dealers who run the games, and the Fed has only pulled the punchbowl in the past when it saw reason to be worried about conventional inflation. Current data isn’t sufficient to get them to do that, but with increasing evidence of the inefficacy of QE in spurring growth and reducing unemployment through trickle down economics, the bartenders will start refilling the bowl more slowly soon. That in itself would not trigger a bear market, but it would make the game much less of a winning hand for bulls.

Track the data that does matter to the market and stay up to date with the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Wall Street Examiner Professional Edition. Try it risk free for 30 days. Don’t miss another day. Get the research and analysis you need to understand these critical forces. Be prepared. Stay ahead of the herd. Click this link and begin your risk free trial NOW!

Read:

- Ben Tapers Taper Talk to Inoculate Market

- Other central banks impacting US money supply

- Adnac – A Blast From the Past Looking Into The Future, Seeing Now

- Winter Says Gold Stocks Are The Cheapest Asset In The World

- Compared to Unemployment Claims Trend, It’s Clear Stocks Are In A Bubble

- Why Neither Manufacturingism nor Servicism Are Good Religions To Follow

Follow my comments on the markets and economy in real time @Lee_Adler on Twitter!

Join the conversation and have a little fun at Capitalstool.com. If you are a new visitor to the Stool, please register and join in! To post your observations and charts, and snide, but good-natured, comments, click here to register. Be sure to respond to the confirmation email which is sent instantly. If not in your inbox, check your spam filter.