Slowing European economic growth coupled with massive, unnatural Central Bank policies has led to a massive bubble in stocks and real estate. All the ECB did was “act (un)naturally.”

“The financial stability environment remains challenging, as the global economic outlook has deteriorated,” Draghi told fellow policymakers on the International Monetary and Financial Committee in Washington.

“There are mild signs of overstretched valuations in the euro area in some riskier segments of the financial markets, as well as in real estate markets, with marked differences across regions.”

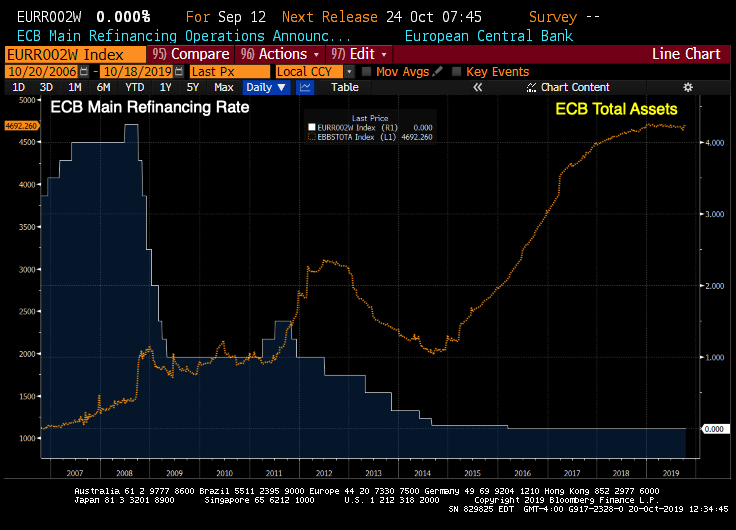

The ECB has acted unnaturally since the financial crisis of 2007-2009 by dropping their main refinancing rate to 0% and rapidly expanding their balance sheet.

In addition, the ECB’s M3 money growth continues to grow.

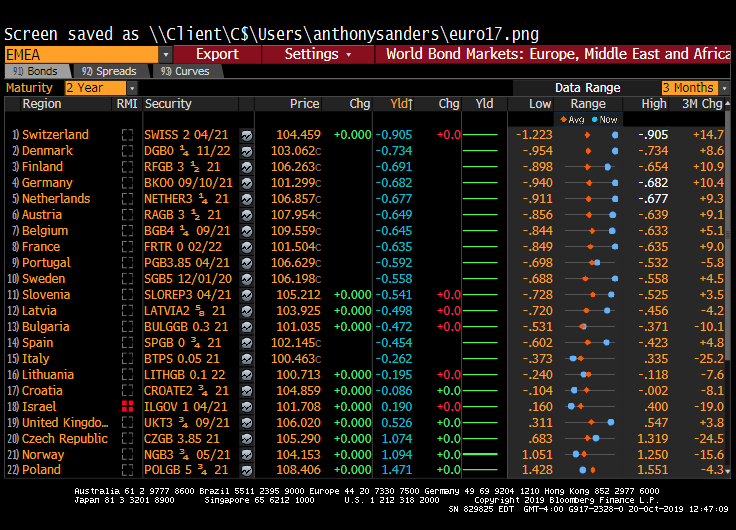

And 17 European nations now have negative 2-year sovereign yields.

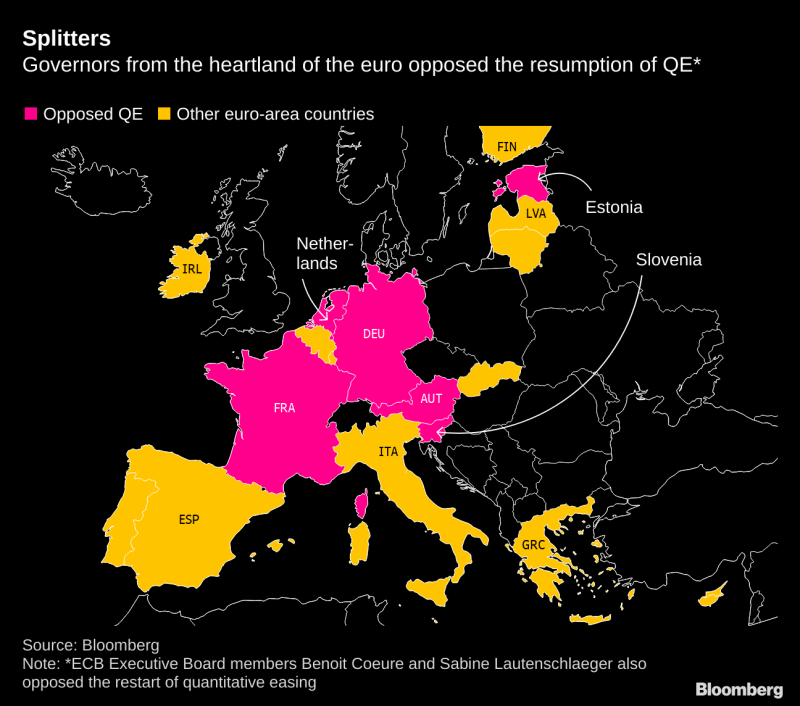

The heartland of Euro (meaning Germany, France and Austria) oppose more QE (asset purchases by the ECB) while peripheral counties (Spain, Italy and Greece) want to keep on expanding the ECB’s balance sheet.

Of course, none of this Central Bank interference is natural and sets the stage for a bubble burst.

ECB’s Draghi is a regular “buckaroo.”

Draghis.

Join the conversation and have a little fun at Capitalstool.com. If you are a new visitor to the Stool, please register and join in! To post your observations and charts, and snide, but good-natured, comments, click here to register. Be sure to respond to the confirmation email which is sent instantly. If not in your inbox, check your spam filter.