This is a syndicated repost published with the permission of NorthmanTrader. To view original, click here. Opinions herein are not those of the Wall Street Examiner or Lee Adler. Reposting does not imply endorsement. The information presented is for educational or entertainment purposes and is not individual investment advice.

We’re in the middle of an existential crisis. We must be. That’s what central bank policies are telling us. After all the ECB cut rates to the lowest ever with its balance sheet being at record highs and expanding. The central bank of Australia today cut rates to their lowest levels ever. These are policies of absolute panic crisis levels are they not? The Fed is intervening in repo markets every single day barely able to keep the effective Fed funds rate at target. They’ve already cut rates twice and are already expanding their balance sheet. Without these interventions markets and the economy would fall apart. That’s the message that is being sent.

In any other time in history all these policy actions and their levels would be regarded as commensurate with a great crisis unfolding.

How is this not a crisis?

Emergency measures have become permanent.

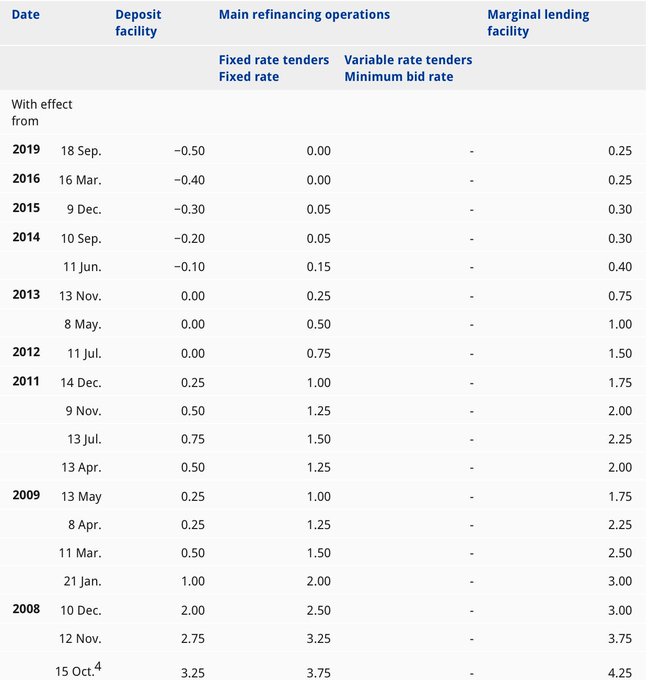

ECB rates since 2008.

Now at the lowest rates ever.

Been at zero or negative for the past 6 years with zero sign of ever getting back to a mere zero.

So I submit to you that if it walks like a duck and quacks like a duck, it’s a duck. Central bank interventions beyond the initial emergency interventions never inspired organic growth, only debt enabled growth and in process all they did is blow an asset bubble, and now that growth is slowing their only solution is aiming to further inflate the asset bubble and risk is that they will succeed as clearly that’s the plan here:

And a bubble it is as earnings growth is going negative:

And as of this moment it looks that’s exactly what is happening. PMI data in the US and Europe today and yesterday were a disaster. 47 in the US, 45.7 in Europe. That’s recessionary. Nobody cares and asset prices keep lifting higher anyways. Well until this morning’s nasty data surprise that is, but will it deter the dip buyers that have been feasting on multiple expansion all year no matter the data?

One has to respect the price action while one must also understand what is happening here. Multiple expansion pure.

And so one must rightly ask is the price discovery mechanism broken? As I’ve outlined on multiple occasions the asset bubble keeps disconnecting ever farther from the underlying size of the economy as wealth inequality keeps expanding as the top 10% basically own all of the assets that benefit from the asset price inflation. The bottom 50% own literally nothing:

Why do equities generally not react to any bad news? It’s a question that one can always ponder at the end of a bubble as clearly this is what has happened numerous times in the past. Equities will keep rising ignoring all bad data and the bubble will run reason defying until it bursts.

But we have a couple new elements in this bubble. One is actually not new, it happened in 2007 as well, but it is happening more aggressively now, the sheer size of buybacks, the key driver of inflows:

$15 trillion in buybacks, nearly $17 trillion in central bank intervention. No reasonable person can state with a straight facet that this has not an artificial inflationary impact on asset prices.

While buyback growth has slowed, 2018 and 2019 are years of trillion dollar liquidity programs running through these markets, programs that buy no matter what. They just allocate keeping a bid under their stocks.

Also mindlessly buying no matter what are ETFs and passive investment flows. Passive assets under management are now larger than active:

These investors don’t really know what they own or care what the prices or valuations are. They just keep allocating cash into an ever shrinking universe of stocks and floats as buybacks keep reducing the available shares to buy expecting returns to always be positive. After all stocks have gone up for 10 years in a row why would that ever change, central banks have our backs and keep inflating the bubble. Besides where else to put our money? Cash? Ha. As rates are either negative or at really low levels not even generating a real return accounting for inflation people keep allocating into stock assets.

And so we end up with the valuation monstrosity that keeps disconnecting ever farther from the underlying size of the economy, the perpetual central bank induced bubble:

I hear a lot of talk about how this is 1998/1999. Fine, then blow the bubble sky high and then end up with a crash. How’s that solve anything?

But clearly this is the risk here.

I keep questioning the efficacy of all this and now that central banks have capitulated and are fully embracing the next intervention cycle I keep looking for signs that the efficacy is waning and that central banks are losing control.

That the recent PMI data is showing no signs of improvement may be such a sign, but the rate cuts are still fresh and early and may take time to filter through, and then of course we still have that permanent carrot of a trade deal hanging in front of us. But that carrot can ill afford to be dangled beyond October 10, markets will want specific progress as data keeps deteriorating:

Central banks pretend there is no crisis. But they sure act like there is a crisis. Perhaps investors should take notice.

Join the conversation and have a little fun at Capitalstool.com. If you are a new visitor to the Stool, please register and join in! To post your observations and charts, and snide, but good-natured, comments, click here to register. Be sure to respond to the confirmation email which is sent instantly. If not in your inbox, check your spam filter.