This is a syndicated repost published with the permission of NorthmanTrader. To view original, click here. Opinions herein are not those of the Wall Street Examiner or Lee Adler. Reposting does not imply endorsement. The information presented is for educational or entertainment purposes and is not individual investment advice.

And yesterday it happened, the big flush following weeks of volatility compression. $ES down 250 handles in a matter of days. Now the bounce. Events like this can be overwhelming and you’ll hear plenty of headline explanations. Sure, headlines matter in the current market environment, but please, don’t let anybody tell you this move was a surprise or was not well advertised in advance. It was.

Let me offer some brief perspectives on both the headlines, macro and the technicals.

Let’s start with macro backdrop. Markets had ignored everything negative in 2019. All of it. Why? Because of the Fed going dovish and offering rate cuts. That was the mantra, that was what everybody was chasing and that’s why people were heavily bullish positioned. Slowing growth or earnings? Who cares? Trade war? Who cares.

If markets had been concerned about the trade war they wouldn’t have traded at all time highs into the Fed. So the trade war didn’t matter until it mattered. It mattered when the Fed juice was no longer enough. It mattered when the technicals said it would.

One month ago, on July 5th I outlined my macro concerns and the technical resistance zone ahead in form of the broadening wedge pattern:

If you haven’t seen the interview I encourage you to watch it or re-watch it. It was all there, including the acknowledged challenge of fading the Sell Zone in an environment of excessive bullishness and central banks eager to push markets higher.

But here is the updated wedge pattern:

Doesn’t mean yet the pattern will come to full fruition, but it shows that, as of now, this pattern is very clean, it was actionable and it has produced a very sizable result.

And frankly speaking: This was a very hard call to make in light of all the bullishness. After all Wall Street was banging the drums. Hard. Examples:

July 15: JP Morgan raises its stock market forecast, sees a China trade deal and an easy Fed. J.P. Morgan ups its S&P 500 price target to 3,200 from 3,000, representing 6.2% upside from Friday’s close

July 30: Goldman raises year-end S&P 500 forecast, sees another double-digit gain in 2020, 3100 for 2019.

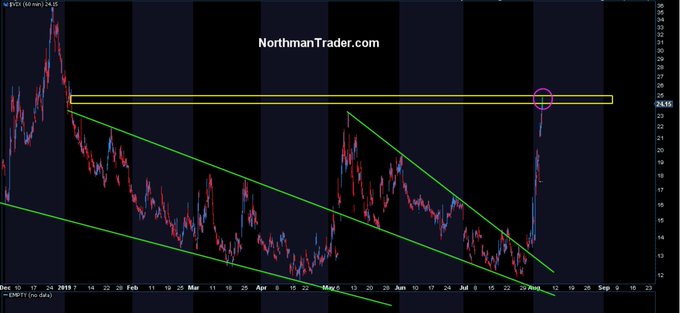

This is a tough environment to put out a contrarian call, not only once, but twice. Doubling down on July 28 with $VIX trading at 12 and calling for a specific 24/25 gap fill:

I actually took a lot of criticism for that call, the typical ‘you can’t chart the $VIX’, he’s just a dumb permabear type pablum nonsense.

Since then: Crickets.

We hit that target yesterday:

Did I expect it to get hit this fast? Heck no, but it did. Technicals are working and they give us targets, structures and signals.

And let me make a perhaps self serving, but hopefully fair point: There is real value in independent market analysis. Look yourself who pushed people bullish into the Fed meeting, look who raised price targets in July, look who suggested buying above $SPX 3,000 was a good idea. Wall Street again led people off a cliff:

I’ve been pointing out to the similarity to the 2018 rally which is crucial to consider what may happen next. In 2018 new highs were made in the summer and all the divergences were ignored and people got hammered. The exact same thing has happened now and a lot of folks are trapped above as this decline was sudden and it was deep. Last night in particular was brutal as $ES got pushed to the lower weekly Bollinger band before the big bounce overnight:

But be clear, technical damage has been done and the 2019 trend from the December and June lows has been broken along with key moving averages. All these will represent resistance on future rallies.

But markets got short term heavily oversold, this was a vicious sell off as evidenced by $NYAD:

The machines that bought everything on the way up, ripped everything to shreds and lot of technical damage was inflicted and they all represent resistance above.

Look at the pattern flags and 200MAs you’ve seen in some of my weekend updates:

All clean flags that broke to the downside. It’s a technical horror show.

So now what? Markets are short term oversold, we’ve filled several of the open gaps we had below, but still have open gaps further below, but now there are also multiple gaps in the other direction, 3 open gaps on the $VIX below.

All this will make the next few weeks a battle for price control.

A couple of comments on the political backdrop: Both sides, China and the US, got a clear signal yesterday: That they are playing with fire here. When the 2 largest economies on the planet threaten to go full bore on a trade war with a fragile global economy at the brink of recession many things can go wrong very quickly. Once sentiment sours with people previously complacent and fully long positioned you get an event like yesterday.

This ups the ante to get a resolution which now makes a deal resolution or signs of improvement and thawing of tension a clear and present danger to bears. But let’s be clear: Should they fail to come to a resolution by September/October risk increases that a global recession unfolds quicker than anyone expects.

I’ve always said this trade war will end once parties are under pressure. Not with markets at all time highs. President Trump may well have felt comfortable to raise new tariffs with $SPX above 3,000.

But Trump has an election to win. While opposition in the US appears hapless and he himself appearing to be his own worst enemy for all the reasons you can guess yourself, the biggest risk to Trump is a US recession into 2020 and he and his team will have to decide how far they are willing to push the buttons as they are playing with fire here.

Bottomline: These markets are now a ping pong game between headlines and any headline can rip participants in every which way. It’s not a comfortable position to navigate through, but it is reality.

Case in point: Last night’s after hour dump came on a headline: The US designates China a currency manipulator. And when you throw such a headline on a scared market panic ensues.

What prompted the overnight rally? Another headline. China pegging its currency at a rate higher than expected. Result: 70 handle ripper.

But these headlines are coming in context of a delicate technical picture. They serve as triggers for selloffs from weak technical conditions at the highs and they can serve as triggers for big rallies off of heavily oversold conditions, but they all fit within larger technical structures.

And these structures keep repeating themselves:

Bottomline: Excessive bullishness, complacency and optimism was punished again. Stock markets have once again retreated from new highs and have now incurred sizable technical damage that will serve as resistance on future rallies.

The larger megaphone technical structure has made its presence felt and the Fed is watching closely as several speakers have already indicated. Given the backdrop the recent rate cut appears to have been a policy mistake. Too soon and too subservient to markets and politics. Has it stimulated the economy and confidence? The recent market actions suggests no.

Earnings are over and suddenly it seems a long time until September. Markets now want another rate cut (do I hear 50bp now?) but even more so they want a resolution to the trade war and its drag on the global economy and confidence. There will come a point where one of the parties will blink. Whether any trade deal is substantive or not will be besides the point. Markets will buy any sign of relief. At least initially. But the macro wheels keep on turning amid ever more inverted yield curves, sinking rates and slowing growth.

So you got your rate cut. Happy?

I suggest everybody, bulls and bears alike, stay sharp and flexible.

Join the conversation and have a little fun at Capitalstool.com. If you are a new visitor to the Stool, please register and join in! To post your observations and charts, and snide, but good-natured, comments, click here to register. Be sure to respond to the confirmation email which is sent instantly. If not in your inbox, check your spam filter.