Things are getting crazy in Europe, particularly in Germany and Denmark,

As Brexit approaches, Germany is desperately trying to save their economy (or at least their banking system) by borrowing at negative rates for 30-years.

The German government sold 869 million euros of 30-year bonds with a negative yield, for the first time ever, adding to the world’s growing $15 trillion in existing negative yielding debt.

The bund, set to mature in 2050, has a zero coupon, meaning it pays no interest. Germany offered 2 billion euros worth of 30-year bunds, and investors were willing to buy less than half of it, with a yield of minus 0.11%.

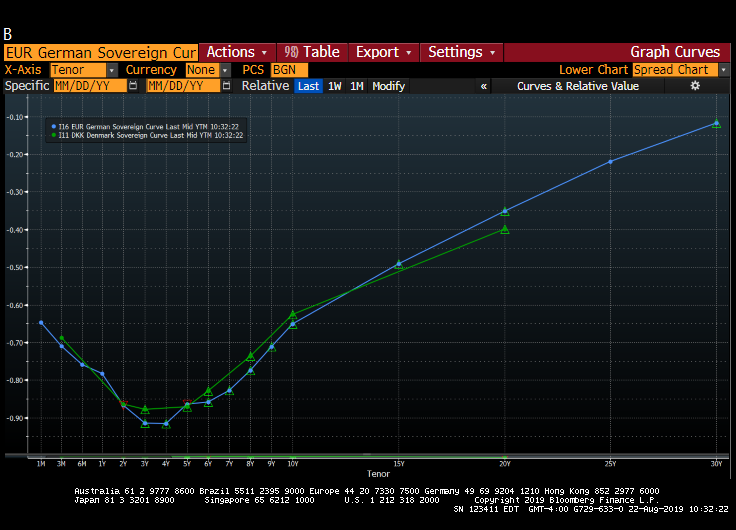

Here are the German sovereign yield curve (blue) and the Danish sovereign curve (green).

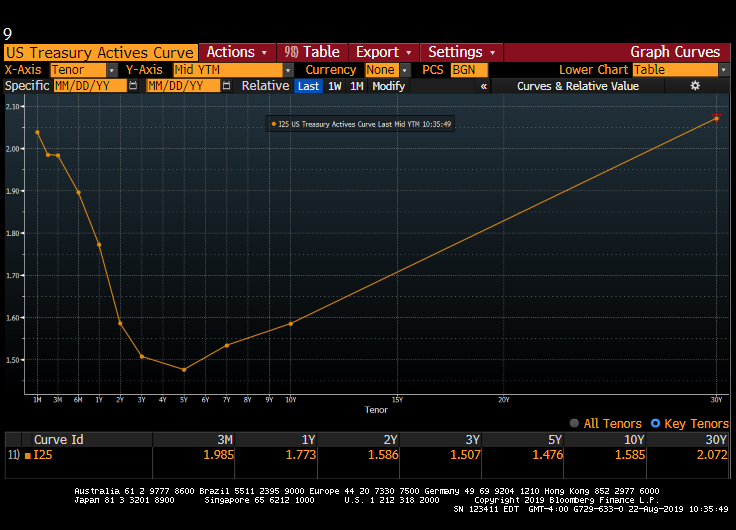

Of course, the US Treasury curve has the same “bucket” shape as Germany and Denmark (as well as numerous other nations).

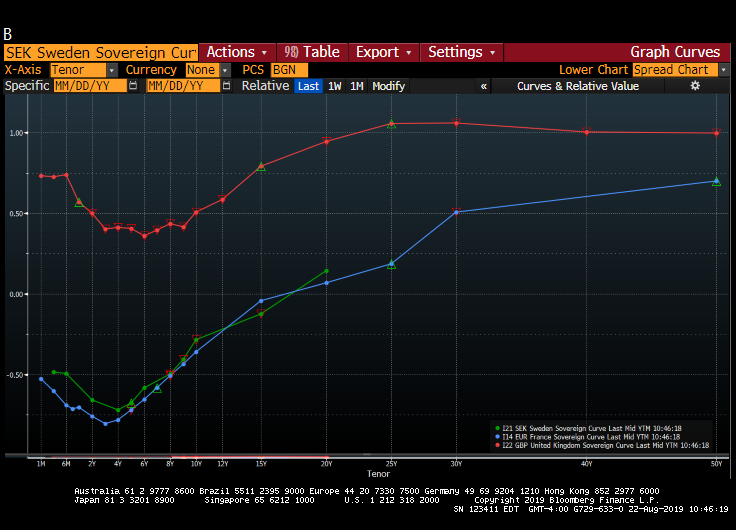

While not totally submerged, Sweden, France and the UK all have the bucket shape.

Just so we understand, it’s not just Europe that is slowing. China is slowing too (and before the tariff war).

Sovereign yield curves are Shakin’ all over.

Join the conversation and have a little fun at Capitalstool.com. If you are a new visitor to the Stool, please register and join in! To post your observations and charts, and snide, but good-natured, comments, click here to register. Be sure to respond to the confirmation email which is sent instantly. If not in your inbox, check your spam filter.