(Bloomberg) Until this month, gold held claim to the title of being one of the most boring asset classes. Prices barely budged and popularity was fading.

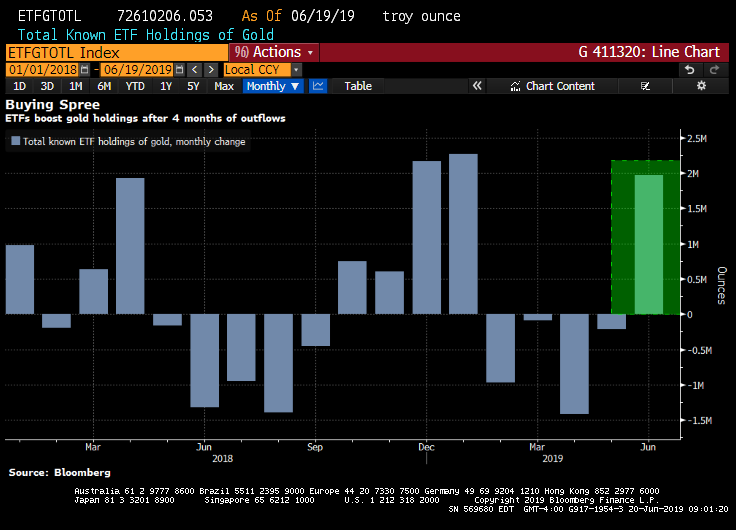

Now that’s all changed. Over the past few weeks, a clear bull case has started to emerge. A key resistance level has broken. Investors are pouring money into exchange-traded funds. The dollar is weakening and the Federal Reserve seems to be charting a path to cut interest rates. China is on a buying spree to stock up reserves.

“It has been a long wait,” said Mark O’Byrne, research director at GoldCore Ltd. “Gold has finally broken out, we nearly touched $1,400.”

Gold rose as much as 2.5% Thursday to the highest since September 2013, and traded at $1,381.64 an ounce at 1:03 p.m. in London.

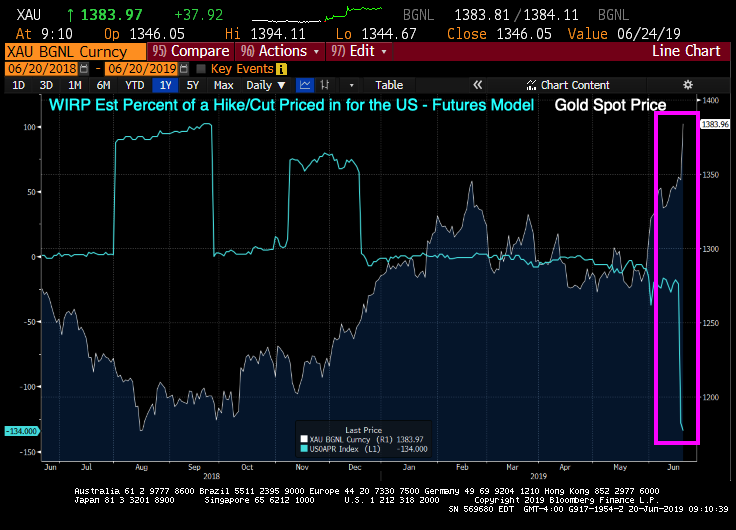

Yes, gold prices are rising as the odds of a Fed rate cut increase.

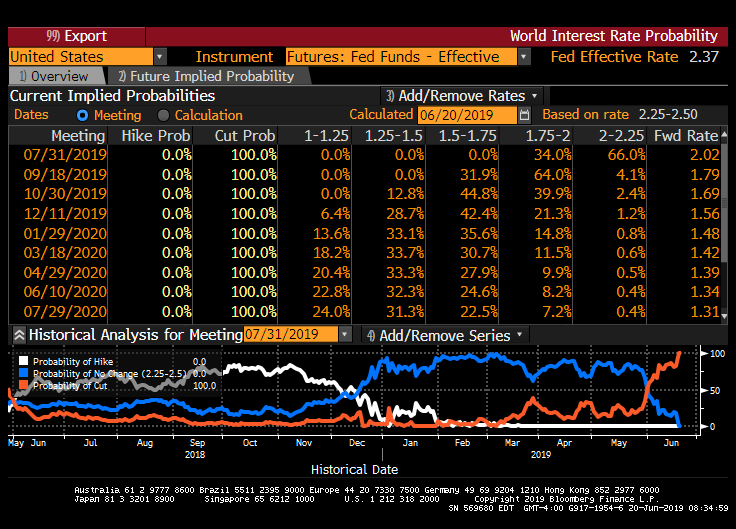

The odds of a Fed rate cut (from Fed Funds futures) is 100%. Only the size of the cut is unknown. But it looks like two cuts by September.

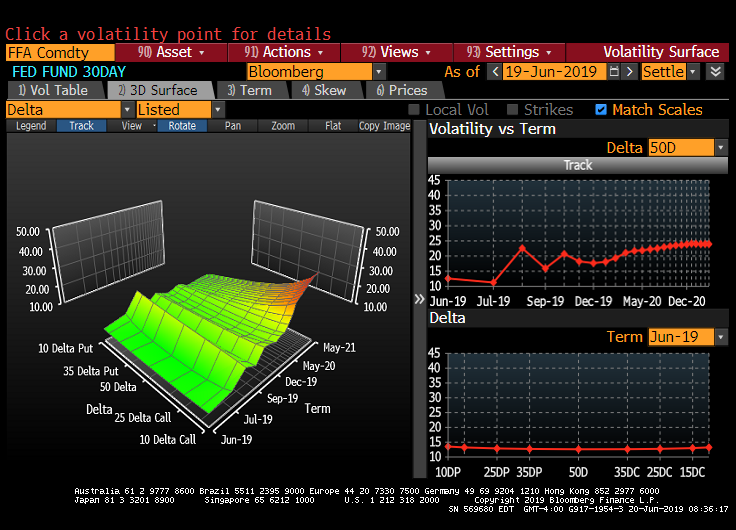

It looks like there is a disturbance in the force (or at least Fed Funds 30 day volatility).

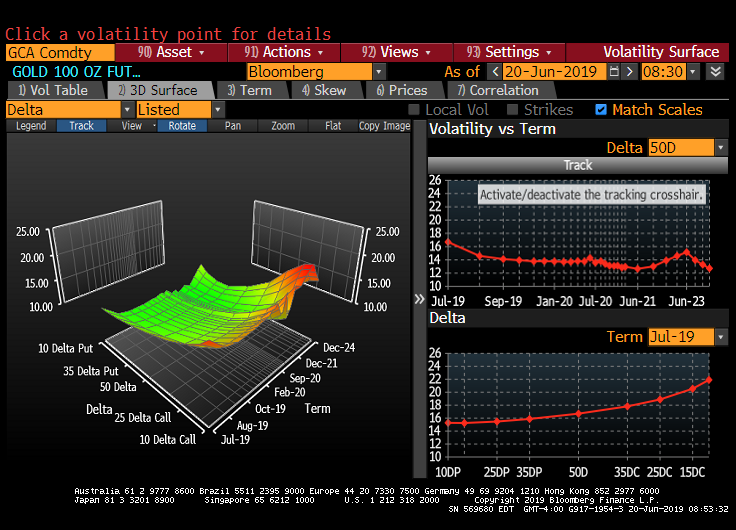

Look at the 10 Delta Call at December maturities for gold!

Gold ETFs are booming again!

Join the conversation and have a little fun at Capitalstool.com. If you are a new visitor to the Stool, please register and join in! To post your observations and charts, and snide, but good-natured, comments, click here to register. Be sure to respond to the confirmation email which is sent instantly. If not in your inbox, check your spam filter.