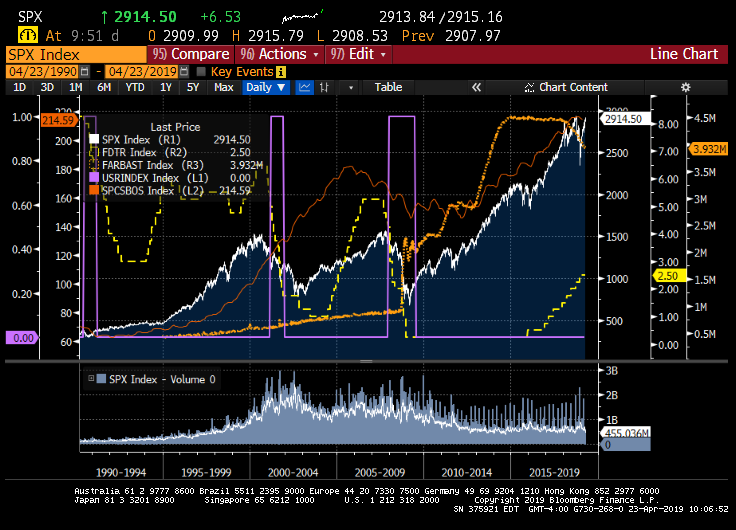

Asset bubbles abound thanks to Central Bank low rate policies. And these aren’t tiny bubbles, but gargantuan asset bubbles.

(Bloomberg) — Some Federal Reserve policy makers seem resigned to running a heightened risk of asset bubbles and other financial excesses as they seek to keep the economic expansion going.

That’s one of the messages tucked inside the minutes of the Federal Open Market Committee’s March 19-20 policy making meeting.

“A few participants observed that the appropriate path for policy, insofar as it implied lower interest rates for longer periods of time, could lead to greater financial stability risks,’’ according to the minutes, published April 10.

Chairman Jerome Powell could be one of those officials. He’s publicly pointed out that the last two expansions ended not in a burst of inflation, but in financial froth, first a dot-com stock market boom, then a housing bubble.

A willingness by the Fed to court such perils by holding rates down should be good for the economy for a while. After all, the aim of such a policy would be to sustain growth at a healthy enough clip to meet the Fed’s twin goals of maximum employment and 2 percent inflation.

But that monetary stance could store up trouble down the road should the financial threats materialize.

“Easy financial conditions today are good news for downside risks in the short-term but they’re bad news in the medium term,” senior International Monetary Fund official Tobias Adriantold a Boston Fed conference last year.

In economists’ parlance, here’s the Fed’s dilemma: R-star — the neutral interest rate that stabilizes the economy when it’s meeting the Fed’s goals — may be so low that it also prompts super-risky behavior by investors.

Behind the fall in R-star: an aging population and slower productivity growth that has boosted savings and depressed investment.

Catch a falling star? Or is it a Death Star?

Join the conversation and have a little fun at Capitalstool.com. If you are a new visitor to the Stool, please register and join in! To post your observations and charts, and snide, but good-natured, comments, click here to register. Be sure to respond to the confirmation email which is sent instantly. If not in your inbox, check your spam filter.