The role of residential mortgage lending has been shifting from large banks to non-banks with the growth of Quicken Loans (and their products Rocket Mortgage). Now we are seeing investors jumping into the housing arena such as FlyHomes.

The idea is relatively simple: A house hunter hires FlyHomes as her broker. When she’s ready to bid on a home, she gives the startup a deposit of 5 percent of the bid price. FlyHomes then makes an all-cash offer for the property, using its line of credit from a bank. After the deal is done, it sells the house to the homebuyer once she’s gotten a mortgage. In return, the company earns the typical 3 percent commission from the original seller.

In tight housing markets, this pitch can be seductive. Stories of house hunters “losing” several homes before getting a bid accepted are legion in greater Seattle, where prices have shot up faster than any other big metro area in the country for 20 months. Cash has long appealed to sellers, because it gives them certainty and puts money in their pocket more quickly. FlyHomes says more than half its offers are accepted.

Yes, the buyer still needs to be taken out of the transaction by a lender. FlyHomes simply acquires the property in hot markets using cash (and a 5% deposit from the borrower). This is an interesting way to bypass the traditional bank lending model in hot property markets.

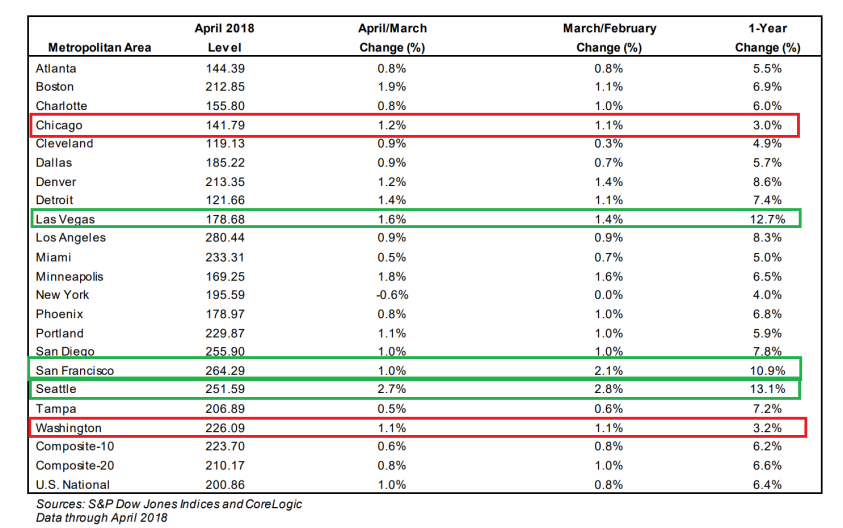

This approach is useful in areas such as Seattle, San Francisco and … Las Vegas. Chicago? Not so much. Here is the growth rates of twenty housing markets according to S&P Case-Shiller:

The problem with Seattle, San Francisco, Los Angeles and other metro areas is … land use restrictions. Land use restrictions lead to bidding wars since additional supply is more difficult to deliver.

According to Housing Wire, the leading mortgage lenders in 2017 were

- United Wholesale Mortgage – 82,231.

- Flagstar Bank – 99,341.

- Caliber Home Loans – 105,371.

- U.S. Bank – 108,171.

- loanDepot – 132,440.

- Freedom Mortgage Corp. – 152,017.

- Bank of America – 152,811.

- JPMorgan Chase Bank – 173,702.

- Wells Fargo Bank – 393,568.

- Quicken Loans – 436,289.

Notice that Citi is no longer in the top ten.

Join the conversation and have a little fun at Capitalstool.com. If you are a new visitor to the Stool, please register and join in! To post your observations and charts, and snide, but good-natured, comments, click here to register. Be sure to respond to the confirmation email which is sent instantly. If not in your inbox, check your spam filter.