This is a syndicated repost published with the permission of The Felder Report. To view original, click here. Opinions herein are not those of the Wall Street Examiner or Lee Adler. Reposting does not imply endorsement. The information presented is for educational or entertainment purposes and is not individual investment advice.

Chris Cole, of Artemis Capital, recently asked, “What investments do you justify by common knowledge today that will look foolish 40 years from now?”

Here are a few I think might qualify:

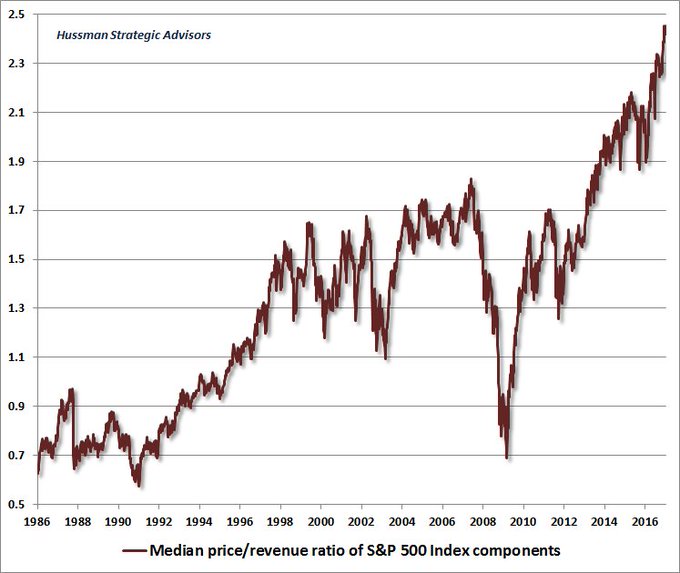

First has to be embracing a passive approach to equity investing just as the median stock becomes more highly valued than ever before in history…

Median price-revenue ratio of S&P 500 components. The 2000 peak focused on a subset of hypervalued large-caps. This is an everything bubble.

…and the smartest guys in the room loudly proclaim, “sold to you!”

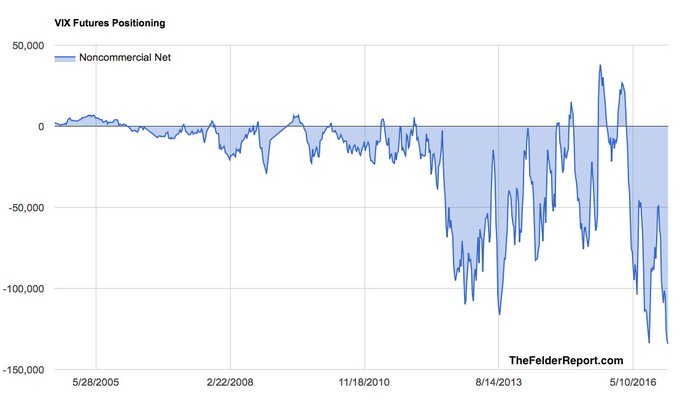

Next I would submit short-selling volatility…

New record this week in speculative net short positions against the VIX:

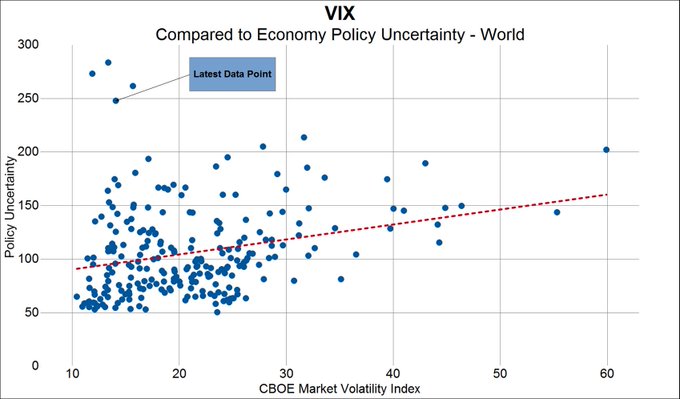

…when economic policy uncertainty is soaring to record highs is probably not very wise, either.

#Gavekal Capital: Given the Level of Economic Policy Uncertainty, The VIX Should Probably Be Higher http://blog.gavekalcapital.com/?p=12660

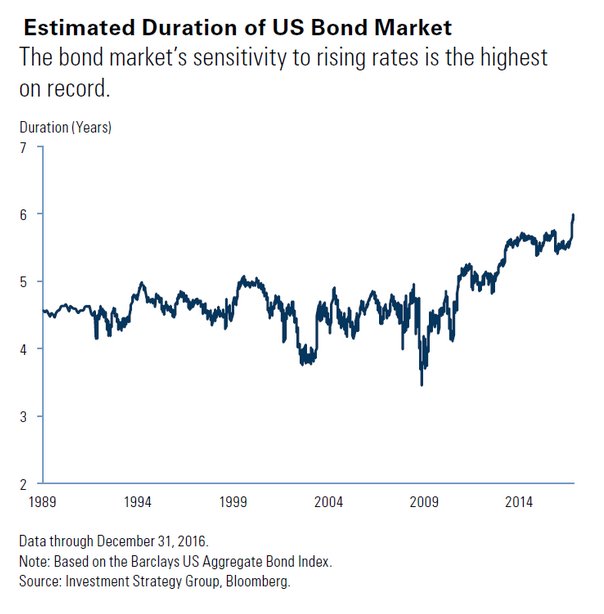

Finally, maxing out the duration of your fixed income exposure…

‘The overall US bond market duration is now the highest on record, making the asset class more vulnerable to losses’ – @SoberLook

…when both nominal and real interest rates test their all-time lows doesn’t strike me as a great recipe for investing success.

For the first time in 30 years the US 30-year Treasury yield has traded below inflation: http://otterwoodcapital.com/blog/bond-market-distortion-us-30-year-bond-yield-falls-below-inflation/ …

Time will tell.

Join the conversation and have a little fun at Capitalstool.com. If you are a new visitor to the Stool, please register and join in! To post your observations and charts, and snide, but good-natured, comments, click here to register. Be sure to respond to the confirmation email which is sent instantly. If not in your inbox, check your spam filter.