Yesterday I posted a report on Federal Withholding Tax collections for September. They were strong. That implied the BLS nonfarm payrolls data to be released Friday should beat downbeat economists’ consensus expectations. But there are problems with both the withholding tax data, and especially the BLS data, that make the market’s focus on the jobs numbers just a little insane.

Yesterday I posted a report on Federal Withholding Tax collections for September. They were strong. That implied the BLS nonfarm payrolls data to be released Friday should beat downbeat economists’ consensus expectations. But there are problems with both the withholding tax data, and especially the BLS data, that make the market’s focus on the jobs numbers just a little insane.

The Daily Treasury Statement from which withholding tax data is derived does not break out how much withholding is payroll and non-payroll related. Several members of the Capitalstool.com message board community, among whom are current money managers as well as past corporate CFO types, have pointed out that withholding on IRA distributions may be having an impact on withholding tax comparisons. IRA investors can request that the IRA managers withhold taxes on the distributions.

Estimating how much impact that might have on the year to year comparisons would be challenging at best. The Monthly Treasury Statement for August showed that the increase in income taxes withheld, which would include the non-payroll withholding was actually smaller than the increase in Social Security withholding, which would include only payroll taxes. That has varied from month to month for most of the year. Income tax withholding gains outstripped Social Security tax withholding in January, February, April, and July. In March, June, and August, Social Security withholding grew more.

The impact of other forms of withholding is one reason why withholding tax collections do not translate directly to job gains. However, I still think it fair to deduce that given the degree of strength in September, that some of the gains were due to jobs, and for this reason the payrolls data should beat the downbeat consensus estimate of +120,000.

The ADP data released today supports that. Their number came in at a gain of 162,000 for September. That substantially beat the consensus estimate of a gain of 133,000. ADP uses the data from 400,000 businesses for which it processes payrolls. For its non-farm payrolls number, the BLS surveys approximately 140,000 businesses by computer assisted telephone surveys and other methods.

Given its larger sample size and use of actual payrolls, the ADP employment estimate is probably a more accurate guide to actual employment trends than is the BLS data. However, the market pays little attention to the ADP data, and focuses almost exclusively on the BLS data. Unfortunately the BLS data is also subject to large annual revisions, called benchmarking, based on collection of actual employment data from unemployment tax returns. The BLS just released a preliminary benchmark revision for the period from April 2011 to March 2012, adding 386,000 jobs. As a result it will also restate the figures not only for that year, but for the period from April to August, revising them up. This does not include the annual backward revisions of the seasonally adjusted data every year for 5 years following the date of the release.

In any given month, the BLS data cannot be trusted to give an accurate picture of employment trends. The government says that that sampling error is in the range of +/- 100,000. This does not include non-sampling error that may be due to other factors. That degree of uncertainty can result in a huge difference to the market. A beat or miss of 50,000 or less versus the consensus often moves the market.

Finally, there’ s the seasonal adjustment problem. Virtually everybody uses seasonally adjusted data because it smooths the month to month and quarter to quarter variations in the data. This results in an abstract data plot that often creates a misleading picture of the the trend. The current month’s seasonally adjusted number isn’t even finalized until 5 years after the release date because the government is constantly trying to adjust the number to more closely and accurately represent the trend of the actual data based on subsequent data. From the BLS monthly press release:

For both the household and establishment surveys, a concurrent seasonal adjustment methodology is used in which new seasonal factors are calculated each month using all relevant data, up to and including the data for the current month. In the household survey, new seasonal factors are used to adjust only the current month’s data. In the establishment survey, however, new seasonal factors are used each month to adjust the three most recent monthly estimates. The prior 2 months are routinely revised to incorporate additional sample reports and recalculated seasonal adjustment factors. In both surveys, 5-year revisions to historical data are made once a year.

Given the unknown impact of non-payroll factors in the withholding tax data and the capricious nature of BLS survey data, perhaps the best measure of employment trends is the weekly unemployment claims data collected by the Labor Department’s Employment and Training Administration. It does not give the whole picture in that it only shows those filing for unemployment, but as a measure of the trend, it is certainly the most accurate and most timely. It consists of an actual count, is available virtually in real time, and the data is reported on both an actual, not seasonally adjusted (NSA) basis and a seasonally adjusted (SA) basis, enabling us to clearly distinguish just how misleading the SA data is. The actual NSA data has shown a steady trend of improvement at a relatively constant rate for the past two years. I will post an update of the charts and data on Thursday.

Given the unknown impact of non-payroll factors in the withholding tax data and the capricious nature of BLS survey data, perhaps the best measure of employment trends is the weekly unemployment claims data collected by the Labor Department’s Employment and Training Administration. It does not give the whole picture in that it only shows those filing for unemployment, but as a measure of the trend, it is certainly the most accurate and most timely. It consists of an actual count, is available virtually in real time, and the data is reported on both an actual, not seasonally adjusted (NSA) basis and a seasonally adjusted (SA) basis, enabling us to clearly distinguish just how misleading the SA data is. The actual NSA data has shown a steady trend of improvement at a relatively constant rate for the past two years. I will post an update of the charts and data on Thursday.

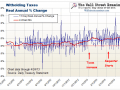

The market isn’t known for its rationality, but investor and media focus on the monthly headline payrolls number is a little insane given the problems inherent in the data. Both the withholding tax data, even though it includes some uncertainty, and the weekly claims data, reflect at least steady growth in jobs. The rate of growth is clearly unsatisfactory for those without jobs, but withholding tax gains of 6.3% over last year in nominal terms and 4.5% in real terms are nothing to sneeze at. The September Monthly Treasury Statement will give us a handle on how much of the gains were definitely payroll related. The monthly statement is usually released on the 8th business day of the month, but September can be delayed by fiscal year end reporting requirements. Once that becomes available we’ll have a better idea of just how far off this month’s BLS data was.

Follow my comments on the markets and economy in real time @Lee_Adler on Twitter!

Stay up to date with the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, along with regular updates of the US housing market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Try it risk free for 30 days. Don’t miss another day. Get the research and analysis you need to understand these critical forces. Be prepared. Stay ahead of the herd. Click this link and begin your risk free trial NOW!

Join the conversation and have a little fun at Capitalstool.com. If you are a new visitor to the Stool, please register and join in! To post your observations and charts, and snide, but good-natured, comments, click here to register. Be sure to respond to the confirmation email which is sent instantly. If not in your inbox, check your spam filter.